HDFS Loan Help!!

#21

Sure it has already been said but since you are at the end of the loan and the balance is low, even with a high-interest rate, interest on the unpaid balance appears low to you. Where they got your money on a hobby was the other 58 payments. Especially, the first few years.

They figure it compounded over all the payments at your rate you accepted and then divide up all equal payments. So, as an example that is easy to understand, the first payment is 90% interest and 10% for the bike. The last payment is 90% bike and 10% interest.

Be sure to get that pay off to them before their date they give you or you are going to find out, you owe some more.

Never ever finance a hobby unless you have the money for a bike and it is making you more money than the loan interest.

They figure it compounded over all the payments at your rate you accepted and then divide up all equal payments. So, as an example that is easy to understand, the first payment is 90% interest and 10% for the bike. The last payment is 90% bike and 10% interest.

Be sure to get that pay off to them before their date they give you or you are going to find out, you owe some more.

Never ever finance a hobby unless you have the money for a bike and it is making you more money than the loan interest.

Last edited by Jackie Paper; 05-16-2018 at 11:14 AM.

#22

Thanks all. The payoff number they gave me was $3693.75. They 14 payments of $249.79 = $3497.06 I would think that would be the payoff number not around $200 more. Even if I don't save a years worth of interest like I thought I would by paying it off early $200 is still $200.

I would think it would be simple but I guess I am wrong. It just sucks I can't get a real answer out of them either way.

I would think it would be simple but I guess I am wrong. It just sucks I can't get a real answer out of them either way.

However this turns out, it will be nice to have it paid for.

The simplest explanation here is that you've miscounted your number of remaining payments.

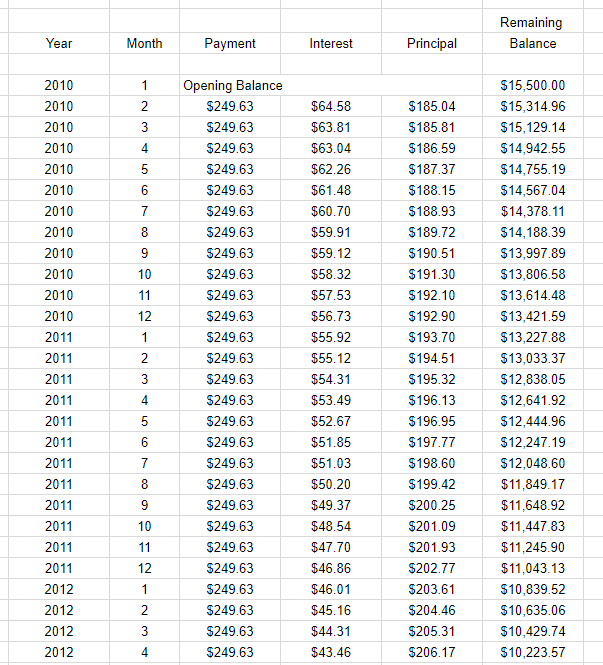

The quickest way to figure out what exactly is going on is to get a complete loan history. It will look something like this:

You'll see every payment you've made, how much of that was for interest, and how much was for principle. I'm guessing this was a simple interest loan, and I'm guessing they are charging interest daily, compounding monthly. Assuming for the sake of discussion that your payment due date is the first of each month, then minor variations on when it arrives can add up. A lot of times, you'll have a ten day grace period, so as long as your payment arrives by the 10th, you don't get a late fee. But that doesn't mean you still aren't accruing interest over those ten days. Your original payment amount was calculated based on the payments being posted exactly on the due date each month. If every one of your payments has instead arrived on the last day of the grace period, that would explain the discrepancy.

The bottom line is you need to see an accounting of every dollar you've sent to them (ie, a complete loan history report), and how each of those dollars was applied. One way or another, I guarantee you it all adds up.

#24

Is the loan like a house loan? In which case all the interest is up front and you won't save much paying it off now.

When we paid off our house they padded a little extra to account for the exact day/hour and minute of the payoff. And refunded us the difference of overpayment.

When we paid off our house they padded a little extra to account for the exact day/hour and minute of the payoff. And refunded us the difference of overpayment.

Last edited by ronaldrwl; 05-16-2018 at 11:27 AM.

#25

Without going into too much detail, the interest portion of a payment is based on which payment number is being paid. For a 5 year loan the interest percentage applied to the first payment is a value calculated by using the number 59 as a multiplier. The next payments use the multipliers 58, 57, 56, etc. until the loan is paid. That is why the interest portion of each payment shrinks, and the principal portion increases, with each payment. That is for compound interest, simple interest is different.

Omaha's table in post #22 is a good example.

Last edited by rjg883c; 05-16-2018 at 11:32 AM.

#26

#27

Join Date: Oct 2013

Location: On the Big Blue marble

Posts: 8,373

Received 4,340 Likes

on

2,199 Posts

Try this: https://financial-calculators.com/auto-loan-calculator

Plug in your numbers, see if your monthly payments match then go to the bottom and look at the payment schedule. Might give you an answer.

Plug in your numbers, see if your monthly payments match then go to the bottom and look at the payment schedule. Might give you an answer.

This wont be accurate because on a vehicle loan, your payments front lod interest then it softens as the term pays down. There should not be a prepayment penalty on your loan. Sounds like you just had a dipshit on the phone

#28

It is either what 0maha said or there is an early payment penalty/fee in there somewhere.

As an aside (and yet another explanation of the same thing), you pay more interest in the early years of a (non-simple interest) loan because you owe more in the early years. As time goes by you owe less, so the amount of interest you are paying is less.

As an aside (and yet another explanation of the same thing), you pay more interest in the early years of a (non-simple interest) loan because you owe more in the early years. As time goes by you owe less, so the amount of interest you are paying is less.

#29

#30

I've had several hdfs loans, and I used to work in banks, so I have a pretty good idea of whats going on. to clear up some misconceptions, hdfs loans are simple interest loans, which means that interest is accrued on the outstanding balance. also, there are no prepayment penalties.

one thing that hdfs does that seems to confuse a lot of people is that if you prepay ahead, they will tell you on your next statement that you have no payment due until x date. ignore that. if you want to pay it off early, continue to make your payments. otherwise, all you have done is to give yourself a 'payment holiday' and your loan will still mature on the same date as the original contract.

I don't understand the animosity held by many to hdfs. it mostly seems to stem from not really understanding your loan. I've personally never had any issue with them. and they've always gotten my title to me in a timely manner.

but to get back with the op, there is no way that your payoff can be more than the sum of your remaining outstanding payments. are you sure you're counting your remaining payments correctly? is it too close to the date of your payment and they haven't counted that one in yet?

like has been said several times already, go the the hdfs website. set up an account if you don't already have one. you can check your complete history, and see a payoff amount as well as your outstanding balance.

one thing that hdfs does that seems to confuse a lot of people is that if you prepay ahead, they will tell you on your next statement that you have no payment due until x date. ignore that. if you want to pay it off early, continue to make your payments. otherwise, all you have done is to give yourself a 'payment holiday' and your loan will still mature on the same date as the original contract.

I don't understand the animosity held by many to hdfs. it mostly seems to stem from not really understanding your loan. I've personally never had any issue with them. and they've always gotten my title to me in a timely manner.

but to get back with the op, there is no way that your payoff can be more than the sum of your remaining outstanding payments. are you sure you're counting your remaining payments correctly? is it too close to the date of your payment and they haven't counted that one in yet?

like has been said several times already, go the the hdfs website. set up an account if you don't already have one. you can check your complete history, and see a payoff amount as well as your outstanding balance.